Planned Giving 101: How to Secure Legacy Gifts for Your Nonprofit’s Future

Planned giving—often called legacy giving—is one of the most potent and underutilized strategies in nonprofit fundraising. While annual gifts and campaigns fund today’s work, planned gifts help ensure your mission thrives for decades to come. These gifts are typically arranged during a donor’s lifetime but realized in the future, often through a will, trust, or beneficiary designation.

For many nonprofits, estate gifts are the most significant single donations they receive from an individual donor. What makes planned giving especially compelling is that it allows supporters to give from assets they may never part with during their lifetime, while still making a meaningful statement about the values they want to carry forward.

With a massive intergenerational wealth transfer underway in the United States, nonprofits that normalize donor legacy planning now are positioning themselves for long-term stability. This explains what planned giving is, the most common types of legacy gifts, how to start a practical planned giving program, and how to steward legacy donors with care and respect.

What Is Planned Giving and Why Does It Matter

Planned giving is when a donor arranges for a gift to benefit a nonprofit in the future. In most cases, that gift is realized after the donor’s lifetime through their estate, though some planned gifts provide income or tax benefits during the donor’s life.

Unlike one-time donations, planned gifts are often made from accumulated assets such as retirement accounts, property, or savings. As a result, even donors who give modestly year after year can ultimately make a transformative contribution. For example, a donor who leaves just five percent of their estate to a nonprofit could be directing tens—or even hundreds—of thousands of dollars toward a cause they care deeply about.

Planned giving plays a crucial role in building nonprofit endowments, funding long-term initiatives, and providing financial resilience during economic uncertainty. For organizations that serve communities over generations, estate gifts can fund programs that would otherwise be out of reach through annual fundraising alone.

Demographics also make planned giving increasingly relevant. Many long-time supporters of nonprofits are older adults actively considering retirement, estate planning, and how to pass on their values. Providing them with a clear, respectful way to leave a legacy ensures your organization remains part of those conversations. Charitable bequests account for a significant portion of total giving in the U.S. each year, underscoring how central estate gifts already are to the nonprofit sector.

Planned giving is not about replacing annual giving; it complements it. When nonprofits treat legacy gifts as a standard and meaningful form of support, they open the door to deeper donor relationships and long-term mission sustainability.

Types of Planned Gifts Explained

Planned giving can sound complex at first, but most legacy gifts fall into a few common categories. Understanding these options helps nonprofits communicate clearly without overwhelming donors.

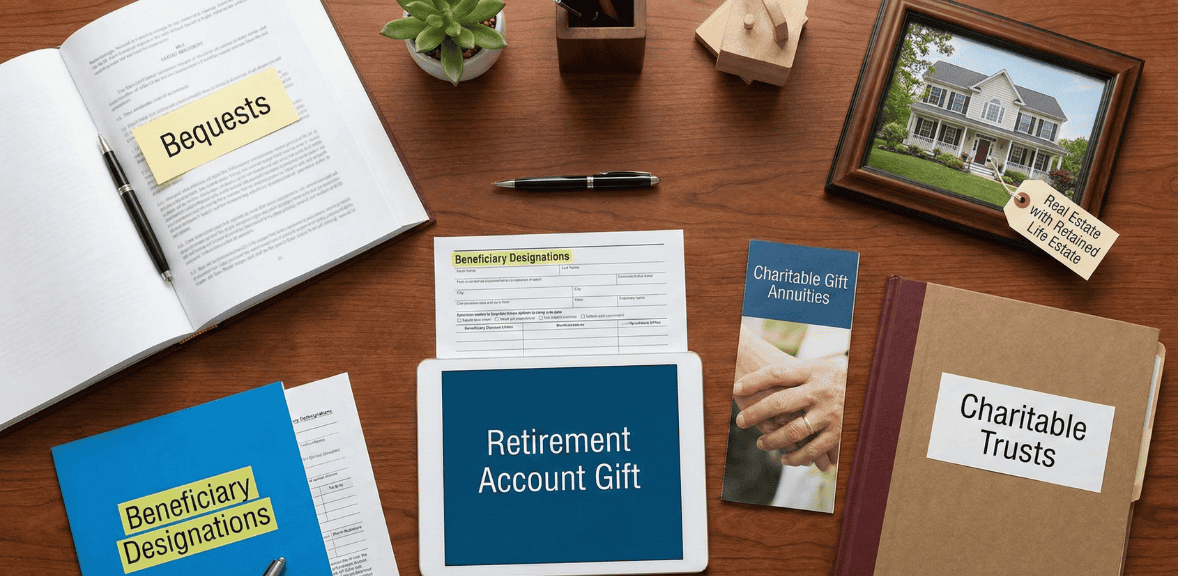

Bequests

Bequests are the most common and accessible form of planned giving. A bequest is a gift made through a donor’s will or living trust, directing assets to a nonprofit upon their death. Donors can structure bequests in several ways, including leaving a specific dollar amount, a percentage of their estate, or what remains after providing for loved ones.

Bequests appeal to donors because they are flexible and revocable. Donors retain complete control of their assets during their lifetimes and can adjust their plans if circumstances change. For nonprofits, bequests are often the starting point of a legacy giving program because they are straightforward to explain and easy for donors to implement with their attorney.

Beneficiary Designations

Another straightforward option is to name a nonprofit as a beneficiary on certain financial accounts. This can include life insurance policies, bank accounts with payable-on-death instructions, or investment accounts.

Beneficiary designations are powerful because they typically bypass probate and are easy to update. Donors can complete them by submitting a form through their financial institution, often without revising their will. These gifts are also private, which appeals to donors who prefer discretion.

Retirement Account Gift

Retirement assets such as IRAs and 401(k)s are particularly tax-efficient vehicles for charitable gifts. When left to heirs, these accounts are often subject to income taxes. When left to a nonprofit, the full value can be used for charitable purposes without tax erosion.

For donors who have other assets to pass on to family, naming a charity as a beneficiary of retirement accounts can be a practical and impactful choice. Many donors are unaware of this option until it is explained clearly, making education especially valuable in this area.

Charitable Gift Annuities

A charitable gift annuity involves a donor making a gift to a nonprofit in exchange for fixed payments for life. After the donor passes, the remaining value supports the organization. These arrangements appeal to donors who want a reliable income and the satisfaction of making a lasting contribution.

Because gift annuities require financial oversight and compliance with state regulations, some nonprofits manage them in-house while others partner with third parties. They are typically used for mid- to large-size gifts and require careful explanation.

Charitable Trusts

Charitable remainder trusts and charitable lead trusts are more complex tools designed for donors with significant assets. Remainder trusts provide income to the donor or other beneficiaries before assets pass to the nonprofit. At the same time, lead trusts direct income to the nonprofit, with any remaining assets returning to the heirs.

These options are usually considered as part of broader estate and tax planning strategies and are less common than bequests. Nonprofits do not need to be experts in trusts to promote planned giving; simply acknowledging these options and referring donors to professional advisors is sufficient.

Real Estate with Retained Life Estate

Some donors choose to give real estate while retaining the right to live in or use the property for the rest of their lives. Upon the donor’s death, ownership transfers to the nonprofit. This type of planned gift can appeal to donors whose wealth is tied up in property rather than cash.

While these gifts require careful evaluation, they illustrate how planned giving can accommodate a wide range of donor circumstances.

Starting a Legacy Giving Program

Launching a planned giving program does not require a large staff or specialized legal expertise. The most successful programs start small and grow over time.

Identifying potential legacy donors is often simpler than expected. Long-time supporters, donors who have given consistently over many years, and individuals who express a deep emotional connection to your mission are strong prospects. Age can be a factor, but loyalty and engagement matter more than wealth.

Clear messaging is essential. A dedicated page on your website explaining planned giving and legacy gifts helps normalize the concept. This page should describe the impact of estate gifts in plain language and include basic information donors need, such as your organization’s legal name and tax identification number. Providing sample bequest language removes barriers and gives donors a concrete next step.

Legacy giving should be promoted gently and consistently rather than through one-time campaigns. Mentions in newsletters, annual reports, and donor communications help reinforce that leaving a legacy gift is a meaningful and appreciated form of support. Simple prompts, such as inviting donors to request more information or notify you if they have included your organization in their plans, can encourage engagement without pressure.

Staff and volunteers who interact with donors should be trained to recognize cues. Comments like “I wish I could do more” or “I’ve been thinking about the future” often signal openness to a legacy conversation. Responding with curiosity and respect keeps the focus on the donor’s values rather than the organization’s needs.

Many nonprofits formalize their efforts by creating a legacy society. These groups recognize donors who have made a planned gift commitment, offering appreciation rather than incentives. Recognition can be public or private, depending on donor preference, and helps build a sense of community around shared values.

Using a donor management system, such as Cloud Donor Manager, can help organizations identify long-term supporters, track legacy intentions, and ensure consistent follow-up. Tools like this support relationship continuity, which is essential for planned giving programs that unfold over many years.

Stewardship of Legacy Donors

Stewardship is the cornerstone of successful planned giving. When a donor informs you that they have included your organization in their estate plans, that information reflects deep trust. How you respond shapes whether that commitment remains in place.

Legacy donors should be engaged as partners in your organization’s future. Invitations to events, personalized updates, and opportunities to hear about long-term plans reinforce their sense of belonging. Even if a donor’s current giving is modest, their future impact may be significant, and stewardship should reflect that reality.

Communication with legacy donors should emphasize vision and stability. These supporters care about the organization’s direction, leadership, and capacity to fulfill its mission well into the future. Sharing strategic plans, impact stories, and thoughtful reflections on growth helps validate their decision to invest in your long-term success.

It is also essential to recognize that most planned gifts are revocable. Donors can change their plans, and that flexibility should be respected. Consistent, thoughtful stewardship reduces the likelihood of changes while honoring the donor’s autonomy.

When a donor passes away, and an estate gift is realized, the organization’s response should be timely, respectful, and aligned with the donor’s intentions. Acknowledging the donor’s family or executor with gratitude and sensitivity reinforces trust and honors the donor’s legacy. Internally, organizations should document the gift carefully and ensure any restrictions are followed.

Some nonprofits choose to share stories of legacy gifts, with permission, to illustrate the lasting impact of donor foresight. These stories help normalize planned giving and demonstrate how estate gifts strengthen the mission over time.

Systems like Cloud Donor Manager can support stewardship by keeping records of donor intentions, recognition preferences, and communication history, ensuring continuity even as staff roles change.

Conclusion: Building a Future That Outlives Us All

Every nonprofit exists because someone, at some point, cared enough to act for the future. Planned giving is the modern expression of that same belief. It allows supporters to say, “This work matters beyond my lifetime,” and it gives organizations the resources to honor that promise.

Legacy gifts are not about asking donors for more today. They are about giving people a meaningful way to align their life’s values with the future they want to help shape. When nonprofits make planned giving visible and accessible, they invite supporters into a deeper relationship—one rooted in trust, continuity, and shared purpose.

The organizations that thrive decades from now will be those that started these conversations early, treated donor loyalty as a long-term asset, and stewarded legacy donors with intention. Even one bequest can change the trajectory of a mission. Even one donor’s foresight can fund programs, protect services, or ensure stability during uncertain times.

Planned giving is not a strategy for “someday.” It is a responsibility to the future your organization serves. By integrating legacy giving into your donor strategy now, you are not just raising funds—you are safeguarding impact for generations yet to come.

FAQs

Our nonprofit is small. Do we really need a planned giving program now?

Small nonprofits often benefit disproportionately from planned gifts. A single bequest of $50,000 can fund years of programming or help stabilize finances during periods of uncertainty. Many donors feel a strong personal connection to smaller organizations and want to ensure their survival. Planned giving also takes time; starting early allows relationships to mature naturally.

How do we talk about wills and estate gifts without seeming insensitive?

Framing matters. Focus on legacy, values, and future impact rather than mortality. Language that emphasizes continuing one’s support beyond a lifetime resonates with donors who are already thinking about responsibility and stewardship. Introducing the concept through stories, newsletters, or educational events helps normalize the conversation.

What materials should we have for planned giving?

At a minimum, a clear website page explaining legacy gifts, sample bequest language, and a contact person for questions. A simple brochure or insert can be helpful for mailings or events. Messaging should be hopeful, respectful, and focused on impact rather than mechanics.

How do we know if someone left us a bequest if they didn’t tell us?

Often, nonprofits learn about bequests after a donor’s death through attorneys or executors. Keeping your contact information accurate and accessible helps ensure that estates can reach you. Encouraging donors to notify you during their lifetime increases the likelihood of known gifts, but unexpected bequests will always occur.

What should we do when we receive a planned gift?

Respond promptly and professionally. Provide any requested documentation, thank the donor’s family or representatives, and handle assets according to your policies and the donor’s wishes. Thoughtful acknowledgment honors the donor and reinforces your organization’s credibility.