Embracing New Donation Technologies: Mobile Wallets, Cryptocurrency, and More

Across the United States, the way people pay has shifted rapidly toward digital-first experiences. Debit cards, mobile wallets, and app-based payments now dominate everyday transactions, from groceries to ride-sharing. Digital giving has evolved alongside these habits, and donor expectations have changed accordingly.

Today, more than half of nonprofit donation traffic comes from mobile devices. At the same time, research consistently shows that more than 60% of online donors prefer digital payment methods. When donation forms are slow, complex to use on a phone, or require manual credit card entry, donors often abandon the process altogether.

New donation technology addresses this problem by reducing friction at the moment of intent. Tools such as mobile wallets, contactless giving, and cryptocurrency donations enable nonprofits to accept gifts in ways that align with how donors already manage money. These options do not replace traditional methods; they expand choice and improve completion rates.

For nonprofits operating in a competitive fundraising environment, adapting to modern fundraising technology is less about innovation for its own sake and more about removing unnecessary barriers. The following sections outline the key technologies shaping online payment methods for nonprofits in 2025, with practical guidance grounded in US donor behavior.

The Shift to Mobile Wallets in Digital Giving

Why Mobile Wallets Reduce Donation Friction

Mobile wallets such as Apple Pay, Google Pay, Samsung Pay, PayPal, and Venmo allow users to store payment information and securely authorize transactions. For donors, this means they no longer need to locate a credit card or manually type billing details, especially on a smartphone.

When donating on a mobile device, every extra step increases the likelihood of drop-off. Mobile wallet integration shortens the donation process to a few taps, which is why nonprofits that enable these options often see higher mobile conversion rates. The improvement comes from reduced abandonment, not pressure or persuasion.

From a donor’s perspective, wallet payments also feel familiar. These tools are already trusted for retail purchases, which lowers hesitation when used for charitable giving.

Common Mobile Wallet Options Used by US Donors

The most widely used mobile wallets in the United States include:

- Apple Pay and Google Pay, especially among smartphone users

- PayPal, often chosen by donors who prefer not to share card details

- Venmo, popular with younger donors accustomed to peer-to-peer payments

Offering multiple wallet options matters because donors have different preferences. A donor who skips a form without PayPal may complete the gift immediately when that option is available.

How Mobile Wallet Donations Work Behind the Scenes

Despite the streamlined donor experience, wallet transactions are processed in the same way as standard card payments. The payment processor handles authorization, and the nonprofit receives funds through its existing merchant account.

In most cases:

- Donor names and email addresses are passed through the transaction

- Receipts can be issued automatically

- Donations appear in reports alongside other online gifts

Testing is essential to confirm that donor data flows correctly into internal systems, but mobile wallet donations rarely require changes to accounting workflows.

Contactless Giving and QR Code Integration

Contactless giving extends mobile wallets beyond websites into physical and hybrid fundraising environments. QR codes printed on signage, mailers, or event programs can open a mobile-friendly donation page where wallet options are already available.

This approach works particularly well for:

- Fundraising events and galas

- Community outreach campaigns

- Religious services and school fundraisers

- Live-streamed or hybrid events

QR codes eliminate the need for donors to remember a web address or wait until later. Capturing intent in the moment increases follow-through, especially when paired with fast wallet checkout.

Implementation Considerations for Mobile Wallets

Most modern donation platforms support mobile wallets, and enabling them is usually straightforward. Nonprofits should focus on:

- Ensuring donation forms are fully mobile-responsive

- Clearly displaying accepted wallet logos

- Testing the donation flow on multiple devices

Visibility matters. Donors are more likely to use wallet options when they see them immediately than when they discover them late in the process.

Cryptocurrency Donations as a Digital Giving Option

Understanding Crypto Donations in a Nonprofit Context

Crypto donations involve donors contributing digital assets such as Bitcoin or Ethereum instead of cash. In the United States, cryptocurrency is classified as property for tax purposes, similar to publicly traded stock.

While crypto donations represent a smaller share of total giving, they have grown steadily, particularly among donors who hold appreciated digital assets. For nonprofits, accepting cryptocurrency is not about chasing trends; it is about accommodating a specific donor segment that already prefers this form of giving.

Why Some Donors Choose Crypto Donations

Crypto donors are often motivated by practical considerations rather than novelty. Common reasons include:

- Donating appreciated assets without triggering capital gains taxes

- Supporting causes while remaining invested in digital assets

- Aligning philanthropy with personal financial tools

For donors with significant crypto holdings, donating directly can be more efficient than selling assets and donating the proceeds in cash.

Managing Volatility and Financial Risk

The primary concern for nonprofits accepting cryptocurrency is price volatility. Digital asset values can change rapidly, creating uncertainty regardless of holding period.

To address this, many nonprofits use third-party services that:

- Accept crypto on the nonprofit’s behalf

- Convert it to US dollars immediately

- Deposit funds directly into the nonprofit’s bank account

This approach minimizes exposure to market swings while still allowing donors to give using cryptocurrency.

Nonprofits should document clear internal guidelines covering:

- Which cryptocurrencies are accepted

- Whether assets are converted immediately

- Conditions under which a crypto gift may be declined

Clear policies support consistency and reduce confusion across finance and development teams.

Acknowledging Crypto Gifts Properly

Crypto donations require a slightly different acknowledgment process. Instead of listing a dollar amount, nonprofits typically:

- Describe the asset donated

- Record the date it was received

- Avoid assigning a monetary value

This approach aligns with IRS guidance for non-cash contributions and places valuation responsibility with the donor.

Also read: Text-to-Give vs. Mobile-Optimized Donation Pages: Which Mobile Strategy Actually Works?

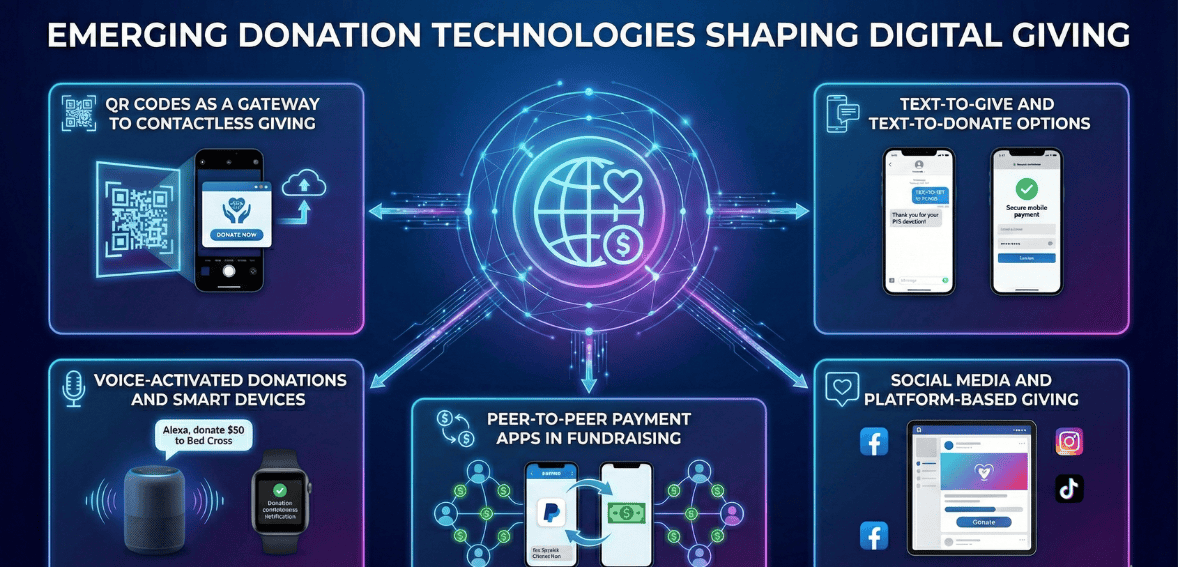

Other Emerging Donation Technologies Shaping Digital Giving

While mobile wallets and crypto donations receive the most attention, several other new donation technology tools are influencing how nonprofits engage donors across channels. These options focus on convenience, speed, and meeting donors where they already use these platforms.

QR Codes as a Gateway to Contactless Giving

QR codes have become a familiar part of daily life in the United States, used for menus, tickets, and payments. In fundraising, QR codes function as a bridge between offline engagement and digital giving.

When scanned, a QR code typically opens a mobile-optimized donation page that includes mobile wallet options, enabling the entire giving process to take less than a minute.

QR codes are effective when:

- Printed on event signage or programs

- Included in direct mail or newsletters

- Displayed during presentations or live streams

Each QR code can be tied to a unique URL, allowing nonprofits to track which campaigns or events drive donations. This makes QR codes both convenient for donors and helpful in measuring results.

Text-to-Give and Text-to-Donate Options

Text-based giving has evolved significantly. Early models often added donations directly to phone bills, which limited gift amounts and delayed the disbursement of funds. Most modern text-to-give systems now work differently.

Today, donors typically:

- Text a keyword to a short number

- Receive a link to a secure donation page

- Complete the gift using standard online payment methods

This approach combines the immediacy of texting with the flexibility of online forms. Text-to-give is especially effective during live events, broadcasts, or time-sensitive campaigns where donors are already engaged but may not want to search for a website.

Voice-Activated Donations and Smart Devices

Voice-activated giving remains an emerging area of fundraising technology. Some large nonprofits have enabled donations through smart speakers, allowing users to say commands such as making a set-dollar donation.

While adoption is still limited, this channel reflects broader changes in how Americans interact with technology. As voice interfaces become more common, expectations for hands-free, frictionless giving may grow.

For most nonprofits, voice donations are not a priority today. However, understanding their potential helps organizations plan for future accessibility and convenience trends.

Social Media and Platform-Based Giving

Social media platforms increasingly integrate donation tools directly into their ecosystems. Features such as donate buttons, story-based fundraising, and live-stream contributions allow supporters to give without leaving the platform.

This type of digital giving works best when:

- The nonprofit already has an active social media presence

- Campaigns are time-bound or tied to storytelling

- Donors are motivated by peer visibility and sharing

Because these platforms often handle transactions, nonprofits should understand how donor data is shared and how gifts appear in their internal records. Integration with existing systems helps avoid data gaps.

Peer-to-Peer Payment Apps in Fundraising

Apps like Venmo and Cash App are commonly used for personal payments, especially among younger donors. Some nonprofits accept gifts directly through these platforms to accommodate donor preferences.

However, peer-to-peer payments can create challenges:

- Limited donor information may be captured

- Receipting may require follow-up

- Reconciliation can be manual if not integrated

When possible, nonprofits benefit from using donation platforms that integrate these apps into a formal donation flow, preserving donor data while still offering preferred payment options.

Implementing New Donation Technology Thoughtfully

Aligning Technology With Donor Demographics

Not every nonprofit needs every payment method. The most effective approach is to match technology choices to donor behavior.

For example:

- Organizations with strong Millennial or Gen Z engagement benefit from mobile wallets and Venmo

- Nonprofits with donors in finance or technology may see value in crypto donations

- Event-driven organizations gain from QR codes and text-to-give

Reviewing donation data, website analytics, and audience demographics provides insight into which online payment methods will have the most significant impact.

Internal Readiness and Financial Oversight

New donation technology affects more than the donation form. Finance, development, and leadership teams should share an understanding of how funds are processed, recorded, and acknowledged.

Key considerations include:

- How each payment method appears in financial reports

- How fees are applied and tracked

- How donor data enters the CRM

Many modern donor management systems, including Cloud Donor Manager, already support multiple digital payment methods within a single reporting structure. This reduces complexity and supports accurate reconciliation without requiring custom processes.

Communicating New Options to Donors

Enabling new payment methods is only effective if donors know they exist. Clear communication helps drive adoption.

Effective tactics include:

- Displaying payment method logos on donation pages

- Adding brief notes in email appeals

- Announcing new options during events or campaigns

Messaging should focus on convenience rather than novelty. Donors respond best when options are framed as making giving easier.

Supporting Donors Across Comfort Levels

While many donors are comfortable with digital payments, some may need guidance. Simple instructions can prevent hesitation.

Examples include:

- Brief explanations near QR codes

- Clear confirmation messages after mobile wallet payments

- Accessible support contact information

Providing reassurance builds trust and reduces frustration, especially for donors trying a new method.

Security, Trust, and Testing

Security remains central to donor confidence. Using reputable providers and recognizable interfaces helps donors feel safe completing transactions.

Before launching new options, nonprofits should:

- Test each payment method with small donations

- Confirm that confirmation emails are sent correctly

- Verify data appears accurately in internal systems

Testing ensures a smooth donor experience and prevents issues that could undermine trust.

Conclusion: Making Digital Giving Work for Today’s Donors

The continued rise of new donation technology reflects how donors in the United States now interact with money in their daily lives. As mobile wallets, contactless giving, and alternative payment options become standard in commerce, donors increasingly expect the same convenience when supporting causes they care about. Digital giving is no longer a supplemental channel; it is a primary pathway through which many supporters choose to engage, especially on mobile devices. When nonprofits remove friction from the donation experience, they make it easier for donors to act on generosity in the moment rather than postponing or abandoning a gift.

Adopting modern fundraising technology does not require chasing every trend or overhauling existing systems. Instead, it involves offering flexible online payment methods that align with donor preferences and usage patterns. Mobile wallets help capture impulse donations on smartphones, contactless tools support in-person and hybrid engagement, and emerging options like crypto donations meet the expectations of specific donor segments. Each of these methods serves a clear purpose when implemented thoughtfully and supported by transparent communication and reliable internal processes.

Ultimately, embracing these tools is about meeting donors where they already are and respecting how they choose to give. When nonprofits prioritize ease, trust, and accessibility, they create a donation experience that feels natural rather than transactional. In a crowded fundraising landscape, that experience can make the difference between intent and action, helping organizations sustain support while adapting to the realities of a digital-first future.

FAQs

Is accepting cryptocurrency safe and legal for nonprofits in the United States?

Yes, US nonprofits can legally accept cryptocurrency, which the IRS treats as property rather than cash. Safety depends on how they are handled, as digital assets can fluctuate in value. Many nonprofits reduce risk by using services that immediately convert crypto donations into US dollars. Clear internal policies help ensure consistent and compliant processing.

How do mobile wallet donations work, and will nonprofits still receive donor information?

The mobile wallet donations process is similar to standard online card payments, using information stored in the donor’s wallet. In most cases, nonprofits receive the donor’s name and email address, allowing for proper receipting and follow-up. Testing the donation flow helps confirm that the required data is captured. Wallet payments mainly simplify the donor’s checkout experience.

Do nonprofits need an IT department to implement new donation technology?

Most nonprofits do not need an IT team to enable modern digital giving options. Many donation platforms already support mobile wallets, text-based giving, and other payment methods through simple settings. Setup usually involves configuration rather than custom development. Coordination with finance ensures accurate tracking and reporting.

Are newer donation methods more expensive because of higher fees?

Fees for mobile wallets are generally comparable to standard credit card processing fees, as they use the same payment networks. Crypto donation processors may charge slightly higher fees to cover conversion and handling. Text-based giving services sometimes add subscription costs. Many nonprofits find improved conversion offsets these expenses.

Are donors actually asking for these digital giving options, or is it just a trend?

Donors do not always specify preferred payment methods, but their behavior indicates clear preferences. Many donors, especially those under 40%, expect mobile wallets and fast checkout options. When these methods are offered, nonprofits often see higher mobile completion rates. The absence of easy options can quietly reduce donations.