Maximizing Corporate Giving: Matching Gifts and Corporate Partnerships Explained

Corporate giving is one of the most significant and most underutilized funding sources for nonprofits in the United States. While individual donors remain the backbone of charitable fundraising, businesses play a growing role in supporting causes that matter to their employees and communities. Much of this support flows through structured programs, including matching gifts, employee giving initiatives, and corporate partnerships.

For nonprofits, the challenge is rarely a lack of generosity. Instead, it is awareness, follow-through, and alignment. Many organizations receive donations each year that could be doubled or even tripled through corporate matching, yet those funds go unclaimed. Others miss opportunities to engage companies whose employees already support their mission.

How corporate giving works in practice, with a focus on matching gifts and employee-driven programs that are accessible to nonprofits of all sizes. It also outlines practical steps for building and maintaining corporate relationships that support long-term fundraising goals.

Understanding Corporate Philanthropy in the United States

Corporate philanthropy refers to the ways businesses support nonprofit organizations through financial contributions, employee programs, and partnerships. In the U.S., companies give through a combination of direct donations, corporate foundations, sponsorships, and employee-participation programs.

While large foundation grants often attract the most attention, two of the most widely available forms of corporate giving are matching gifts and employee giving programs. These channels matter because they do not require a nonprofit to win a competitive grant or secure a formal sponsorship agreement. Instead, they build on existing donations and volunteer activity.

Common Forms of Corporate Giving

Most U.S. companies that give charitably do so through one or more of the following approaches:

- Direct corporate donations or grants, often made through a corporate foundation

- Matching gift programs, where a company matches donations made by its employees

- Workplace giving programs, including payroll deductions and annual giving campaigns

- Volunteer grant programs, where companies donate based on employee volunteer hours

- Corporate sponsorships, tied to events, programs, or campaigns

Among these options, matching gifts and employee giving programs are especially important because they connect corporate philanthropy directly to individual donors. When a nonprofit helps a donor access these programs, it increases the value of that donor’s gift without asking the individual to give more out of pocket.

Corporate giving in the U.S. has continued to grow, with businesses contributing tens of billions of dollars annually. A significant portion of that funding flows through employee-related programs, making them a critical focus for nonprofit fundraising strategies.

Matching Gifts: One of the Most Overlooked Fundraising Opportunities

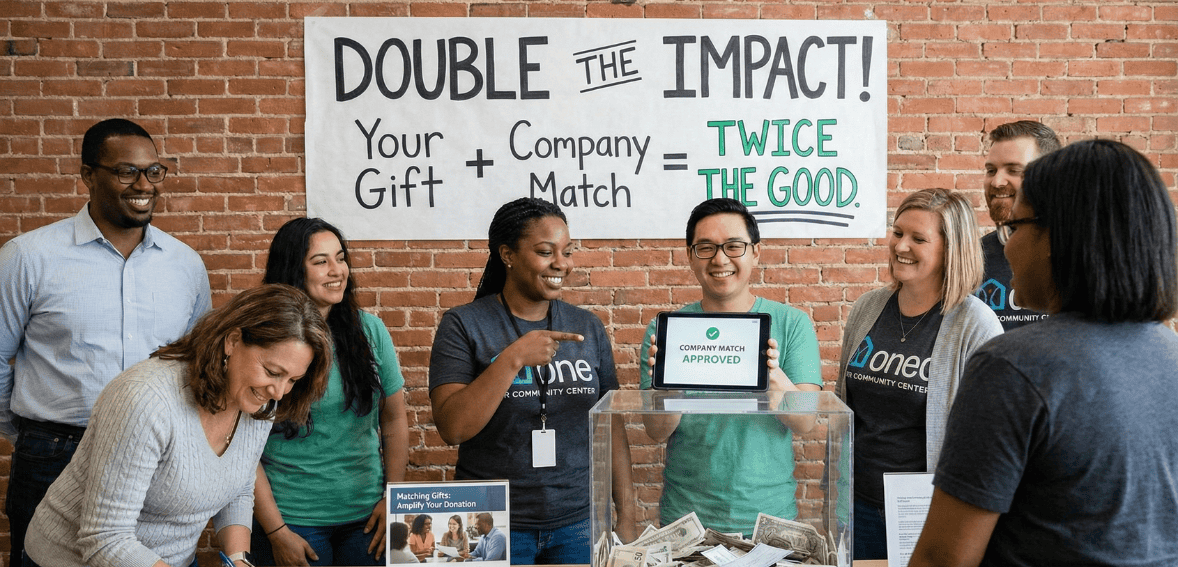

Matching gifts are one of the simplest ways nonprofits can increase revenue, yet they remain widely underutilized. A matching gift program allows a company to match an employee’s charitable donation to an eligible nonprofit, often at a 1:1 ratio.

In practice, a $100 donation can become $200 with minimal additional effort from the donor.

How a Typical Matching Gift Program Works

Although each company has its own rules, most matching gift programs follow a similar process:

- An employee makes a personal donation to a qualified nonprofit organization.

- The employee submits a matching gift request through their company’s online portal or form.

- The nonprofit verifies the original donation.

- The company sends a matching contribution to the nonprofit.

From the nonprofit’s perspective, the additional funds often arrive weeks or months after the original donation. This delay is normal and should be accounted for in revenue tracking and cash flow projections.

Common Matching Gift Guidelines

While policies vary by employer, many U.S. matching gift programs share these characteristics:

- A 1:1 match ratio is most common, though some companies offer higher ratios

- Annual match limits often range from $1,000 to $5,000 per employee

- Minimum donation amounts may apply

- Deadlines typically require employees to submit match requests within a set timeframe

- Some organizations exclude certain types of nonprofits, such as political entities

Understanding these general patterns helps nonprofits set realistic expectations and explain the opportunity clearly to donors without overwhelming them with fine print.

Why Matching Gifts Matter for Nonprofits

Matching gifts matter because they unlock existing funding. The donor has given. The company has set aside money for matching. The only missing step is awareness and follow-up.

Many donors do not realize their employer offers donation matching. Others assume the process is complicated or time-consuming. In reality, most requests take only a few minutes to complete once the donor knows where to go.

For nonprofits, even modest improvements in matching gift participation can have a noticeable impact. Increasing match utilization among existing donors often yields better results than acquiring entirely new supporters.

Matching gifts also reinforce donor satisfaction. When donors see their contributions doubled, they feel their gifts have a greater impact, which can strengthen long-term loyalty.

Practical Steps to Increase Matching Gift Revenue

Nonprofits do not need a large staff or specialized department to benefit from matching gifts. What they do need is a consistent system for reminding donors and making the process straightforward.

Promote Matching Gifts at Key Moments

The most effective time to mention matching gifts is when a donor is already engaged. This includes:

- On donation forms, with a short note encouraging donors to check employer eligibility

- On confirmation or thank-you pages immediately after a gift is made

- In follow-up emails or letters acknowledging the donation

The message should be brief and action-oriented. The goal is not to explain every rule, but to prompt the donor to check whether a match is available.

Make Employer Information Easy to Share

Collecting employer information helps nonprofits identify potential matching gift opportunities. This can be as simple as adding an optional field to a donation form to collect the donor’s employer name.

Once this information is available, staff can prioritize outreach to donors whose employers are known to offer matching gifts. A short, personalized reminder often leads to successful match submissions.

Some organizations use donor management systems, such as Cloud Donor Manager, to track employer data and follow up on pending matching gifts without adding unnecessary administrative burden.

Follow Up Without Adding Pressure

A single reminder is often enough. If a donor does not complete a match request, it is usually due to timing or competing priorities rather than a lack of interest.

Effective follow-up messages:

- Acknowledge the original donation

- Briefly restate the matching opportunity

- Offer help if the donor has questions or needs verification

This approach respects the donor’s time while keeping the opportunity visible.

Employee Giving Programs Beyond Matching Gifts

Matching gifts are only one part of employee-centered corporate giving. Many U.S. companies also support nonprofits through structured employee giving programs that create recurring or cumulative impact.

Payroll Giving and Workplace Campaigns

Payroll giving allows employees to donate a small amount from each paycheck to selected nonprofits. Over time, these contributions add up, providing nonprofits with a more predictable revenue stream.

Some companies run annual workplace giving campaigns, allowing employees to choose charities to support during a defined period. These campaigns may include company incentives, leadership participation, or internal recognition.

For nonprofits, inclusion in a workplace campaign can lead to:

- Recurring donations throughout the year

- Increased visibility among employees

- Opportunities to engage volunteers or advocates

Gaining access to these programs often starts with existing supporters at the company who are willing to recommend the nonprofit internally.

Volunteer Grant Programs

Volunteer grant programs, sometimes called “dollars for doers,” reward employee volunteerism with financial contributions to nonprofits. When an employee volunteers a certain number of hours, the company donates a set amount to the organization.

Nonprofits can support these programs by:

- Tracking volunteer hours accurately

- Informing volunteers that their time may qualify for a grant

- Assisting with verification when required

Volunteer grants strengthen the connection between service and funding, reinforcing the value of both.

Corporate Sponsorships and In-Kind Support

Corporate sponsorships are a form of corporate giving in which a business provides financial or in-kind support for a specific nonprofit activity. Unlike matching gifts, sponsorships are initiated by the company and typically involve public recognition.

For nonprofits, sponsorships work best when tied to a concrete initiative, such as an event, program, or community initiative. Businesses are more likely to support efforts that align with their values or customer base.

In-kind support is another valuable form of corporate philanthropy. Instead of cash, a company may donate goods or services that reduce a nonprofit’s expenses, such as printing, food, technology, or professional expertise.

Examples of in-kind support include:

- A local business providing food or supplies for a fundraiser

- A company offering pro bono marketing or legal services

- A retailer donating products for an auction or program use

Both sponsorships and in-kind donations free up nonprofit resources while giving companies visible ways to demonstrate community involvement.

How to Approach and Cultivate Corporate Partners

Successful corporate partnerships often begin with existing relationships. Donors, board members, volunteers, and staff frequently have workplace connections that can open doors more effectively than cold outreach.

When approaching a company, research is essential. Many U.S. businesses publish their corporate philanthropy priorities, which may focus on education, health, local communities, or employee-selected causes. Aligning your mission with those priorities increases the likelihood of engagement.

A strong outreach message should clearly explain:

- What your nonprofit does and who it serves

- How the company’s support would be used

- Why the partnership makes sense for both sides

Avoid general requests for “support” without specifics. Companies respond better when the ask is clear, measurable, and tied to outcomes they care about, such as employee engagement or local impact.

Once a partnership begins, consistent communication matters. Even simple updates on how funds or services were used help build trust and demonstrate the organization’s reliability.

Long-Term Stewardship Strategies for Corporate Giving

Corporate relationships benefit from intentional stewardship, just as individual donors do. The difference is that companies often evaluate partnerships annually, making follow-up and reporting especially important.

Effective stewardship focuses on impact rather than promotion. Businesses want to know whether their contribution made a difference, whether through increased program reach, employee participation, or community outcomes.

Strong stewardship practices include:

- Sharing brief impact summaries after a campaign or event

- Acknowledging corporate support in appropriate public channels

- Keeping partners informed about future opportunities that align with their interests

Tracking corporate interactions over time helps nonprofits identify patterns, such as repeat sponsors or companies with active employee giving. Organized records make it easier to renew partnerships and build deeper engagement in the years ahead.

Over time, consistent stewardship can turn a one-time sponsorship or matching gift relationship into ongoing corporate support.

Conclusion: Turning Corporate Giving Into Sustainable Support

Corporate giving is not a separate fundraising channel; it is an extension of the relationships nonprofits already have with their donors, volunteers, and communities. Matching gifts, employee giving programs, and corporate partnerships all build on existing goodwill, making them practical tools rather than speculative opportunities.

For many U.S. nonprofits, the most immediate gains come from matching gifts. These programs allow organizations to increase revenue without asking donors to give more, simply by helping them access benefits their employers already offer. When promoted consistently and followed up thoughtfully, matching gifts can become a reliable source of additional funding.

Beyond donation matching, employee giving programs, volunteer grants, sponsorships, and in-kind support offer ways to deepen engagement with businesses that value community impact. The most successful partnerships are built on alignment, clear expectations, and regular communication, not one-time requests.

By treating corporate giving as an ongoing strategy—supported by donor awareness, internal tracking, and strong stewardship—nonprofits can move from leaving money unclaimed to building sustainable business relationships. Over time, these efforts strengthen financial stability, expand reach, and ensure that corporate support becomes a dependable part of long-term fundraising success.

FAQs

How can a nonprofit find out if a donor’s employer offers matching gifts?

Asking donors during or after the donation process is the most effective method. Many employees are eligible but unaware of their company’s donation matching program. Reviewing employer information already collected can also reveal opportunities for follow-up.

What limits or rules usually apply to matching gift programs?

Most U.S. matching gifts follow a 1:1 ratio, with an annual cap per employee. Companies often set minimum donation amounts and submission deadlines. Donors should confirm eligibility details with their employer’s HR or giving portal.

How can nonprofits encourage more donors to use matching gifts?

Clear reminders placed on donation pages and in thank-you messages work best. Donors are more likely to participate when the process is explained briefly, and help is offered if verification is needed.

What is the difference between matching gifts and corporate sponsorships?

Individual employee donations trigger matching gifts and usually involve no public recognition. Corporate sponsorships are direct business contributions tied to events or programs and often include visibility or acknowledgment.

How can a small nonprofit with limited resources get started with corporate giving?

Small nonprofits can begin by focusing on matching gifts and local businesses. Promoting employer donation matching requires little upfront cost and builds on existing donors. Local companies are often open to modest sponsorships or in-kind support, especially when there is a clear community connection.