In-Kind Donation Tracking, Valuation, and IRS Compliance

In-kind donation tracking is essential for nonprofit organizations and charities, which do not only get money. Goods, services, and professional time often play a very important part in helping organizations to achieve their aims. These non-cash contributions, referred to as in-kind donations, have the potential to supply the programs with a considerable amount of power and also to cut down on the operating costs. However, many of the nonprofit organizations find it difficult to keep track of these donations correctly, assign the proper value to them, and fulfill IRS requirements at the same time.

Inadequate tracking of in-kind donations creates inconsistencies in financial records, undermines the trust of people in the organization, and raises the risk of non-approval by the IRS. When there is no clear system in place, nonprofits may underreport contributions, issue tax acknowledgments that are not correct, or fail an audit. Such problems can not only negatively affect the trust of the donors but also expose the organization to penalties.

This detailed manual will assist charities and nonprofits in having a clear and open management of donations in kind. It clarifies what is considered an in-kind gift, the steps of recording and appraising the donations, and the ways of meeting the federal government’s reporting requirements. By having the correct approach, the non-profits can turn their monitoring of in-kind donations into a strength that backs up accountability, precision in reporting, and durability of their operations in the long run.

Understanding In-Kind Donations in the Nonprofit Sector

The term “in-kind donations” denotes donations that coincide with goods, rather than cash, offered to a nonprofit organization. These “gifts” can be for different undertakings like operating, running various programs, or even raising funds, and in all these cases, there will be no direct monetary exchange taking place.

Some common examples of in-kind donations are the huge range of items available from donated equipment, office supplies to food, clothing, software licenses, advertising space, or even professional services such as legal advice or graphic design. Besides, some nonprofits receive in-kind donations such as event space, transportation, or construction labor.

It becomes difficult to track in-kind donations since the variety of the gifts is so vast that they differ tremendously in form and value. They also come without a clear dollar amount attached; thus, the difficulty in the documentation process gets deeper.

Moreover, Nonprofit firms always run the risk that they may not be aware that what they have received in the form of a donated item does not qualify for the donor as a tax-deductible contribution. The IRS has laid down rules specific to the nature of the gift, its value, and the way the nonprofit uses it. A correct classification at the moment of receipt will safeguard both the organization and the donor.

Why In-Kind Donation Tracking Matters for Nonprofits

In-kind donations frequently constitute a considerable part of a nonprofit’s overall support. If organizations inadequately track in-kind donations, the financial reports will not display the total resources received correctly.

The tracking of in-kind donations accurately brings about financial transparency. It permits nonprofits to portray the entire program costs and operational support. This data is a significant source of information for grantmakers, boards, and auditors as they judge the efficiency and impact of the respective organization.

Moreover, tracking helps in nurturing relationships with the donors. Proper acknowledgment and accurate tax documentation are the things that donors giving goods or services are expecting. By keeping orderly records, nonprofits will be able to provide quick responses to donor inquiries and compliance requests.

From the operational point of view, tracking donations helps nonprofits deal with inventory, resource allocation, and duplication. A structured procedure guarantees that the goods donated are distributed to the programs that need them the most.

In-Kind Donations Nonprofits Commonly Receive

Different kinds of in-kind donations are garnered by nonprofits, and each type requires distinctive means of tracking and reporting.

Donated Goods

Things in this category are actual products like food, clothing, medical supplies, furniture, computers, and vehicles. The nonprofits will have to keep track of the item descriptions, the current situation, the date of receipt, and the reason for that item being there.

Public services like accounting, legal advice, medical care, or consultancy may be accepted if they meet the IRS requirements. The general volunteer time does not classify as a deductible service, although the organization reaps the actual benefits from it.

Donated Use of Facilities or Space

This includes no-cost access to event venues, office space, or storage facilities, for instance. These donations typically need thorough documentation to support the claim of fair value.

Donated Advertising and Media

When third-party promotional services are provided and used for nonprofit purposes, they can be considered as in-kind gifts in the case of free advertising space or airtime.

Documentation is necessary for each type of in-kind donation to clarify the valuation and ensure the accuracy of reporting.

Establishing a Reliable In-Kind Donation Tracking Process

The tracking of in-kind donations to be effective is based on a consistent process. Nonprofit organizations must set up documented policies that determine the manner in which the contributions of non-cash are dealt with by the personnel from receipt to reporting.

The procedure should initiate at intake. Staff must document the particulars of the donation as soon as the contribution is made. Delayed recording usually results in loss of information and errors in valuation.

Next, organizations should consolidate the documentation. Keeping the donation data in different spreadsheets or conversation threads via email only increases the risk of discrepancies. A common system not only increases the probability of correctness but also facilitates access.

The approval workflows also play a vital role. By specifying who verifies the details of the donation, who assigns the value, and who sends out the acknowledgment, the responsibility is ensured.

Lastly, nonprofits should frequently carry out the in-kind donation record checking. Regular audits will help in the early detection of errors as well as in the maintenance of compliance over the course of the year.

In-Kind Donation Valuation: What Nonprofits Should Know

The evaluation of in-kind donations is a valuation process that determines the treatment of non-monetary donations in the financial statements and reports, making accurate in-kind donation tracking essential. Nonprofits do not directly value the donations for the donors, but they are required to record a reasonable estimated value for their accounting purposes.

Fair market value, according to the IRS, is the amount that a willing buyer pays to a willing seller for the specific item or service, which serves as a foundation for consistent in-kind donation tracking. Nonprofits should try to use objective evidence for their valuations whenever they can.

For example, in the case of donated goods, it may be retail prices, resale listings, or independent appraisals for expensive items, all of which support reliable in-kind donation tracking. For services, often the valuation is based on an hourly rate charged by the professional in that particular locale.

Nonprofits should definitely not inflate values, as improper in-kind donation tracking can distort financial reports and may also trigger extra scrutiny in audits. Conservative and well-documented estimates are thus the best way to maintain credibility.

Therefore, the very organization that has performed the valuation of in-kind donations is the one that should present the documentation of how the organization determined the in-kind donation valuation, reinforcing transparency through accurate in-kind donation tracking.

IRS Rules Governing In-Kind Donations

Nonprofit organizations that are compliant with the IRS need to pay great attention to the acknowledgment and reporting of in-kind donations, making accurate in-kind donation tracking essential. The IRS has different ways of treating these donations in comparison to cash contributions.

Written acknowledgment for in-kind donations worth $250 or more must be provided by the nonprofits as part of proper in-kind donation tracking. The acknowledgment needs to mention the item or service that was donated, but it should not mention the dollar amount. Giving a value to the donor goes against the IRS rules.

In the case of certain very valuable donations, donors have to get certified appraisals done and also fill out additional forms for the IRS, which directly affects in-kind donation tracking practices. Although it is the donor who determines the value, the nonprofit organizations have to make sure that they fill in and sign the acknowledgment sections correctly.

The in-kind donations also have to be reflected in the annual financial statements and Form 990 of the nonprofits as part of consistent in-kind donation tracking. If the donations are appropriately classified, it will not only be in compliance but also exhibit the full support of the organization.

It is very important for nonprofits to understand these requirements, as effective in-kind donation tracking is crucial for IRS compliance and also for the stability of the organization over the long term.

Tax Receipt Requirements for In-Kind Donations

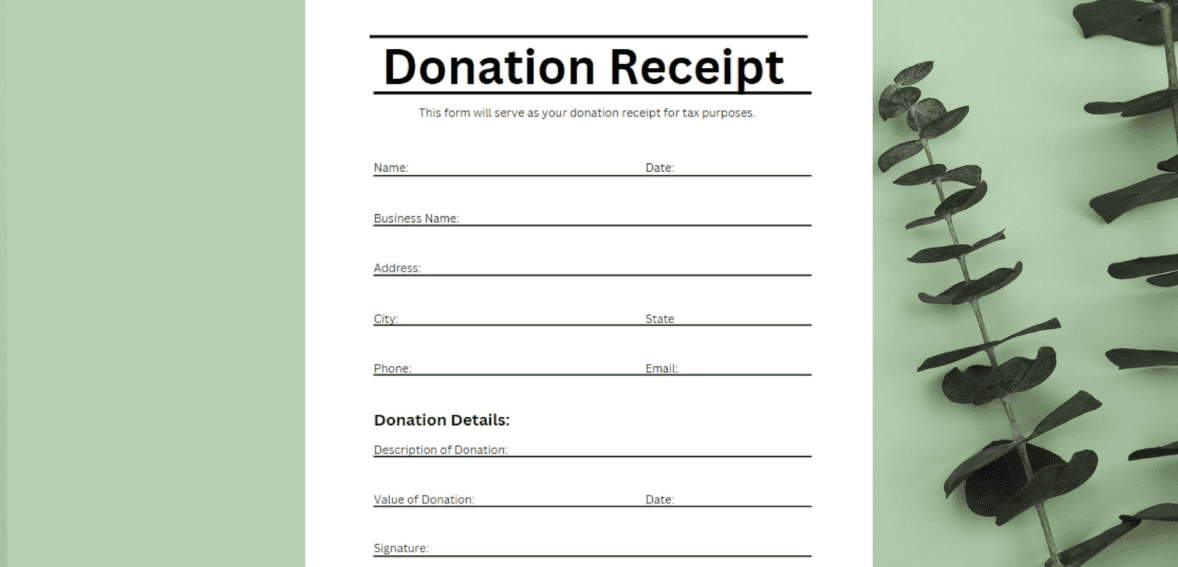

There are different requirements for tax receipts depending on the type and amount of the in-kind donation. Nonprofits have to very carefully prepare their acknowledgments in a way that they meet the federal standards.

For the donated items and the qualifying services, the tax receipt should contain the following:

- The name of the nonprofit and its EIN

- The donation date

- A thorough description of the donated item or service

- A declaration about whether any goods or services were provided in return

The receipt should not put a dollar amount on the gift. Donors decide on the amount they can deduct according to IRS rules and their own documentation.

Nonprofit organizations might lose their donors’ tax deduction and incur penalties by not meeting the conditions for tax receipt issuance. A combination of using standard templates and following a review process is an effective way to minimize this risk.

Recording In-Kind Donations in Financial Statements

The proper financial reporting guarantees that in-kind donations are reflected correctly in the accounting records of a nonprofit organization, making accurate in-kind donation tracking essential. The generally accepted accounting principles prescribe that the nonprofits record the qualifying in-kind contributions as both revenue and expense.

This way of accounting shows the actual cost of the programs and operations, which is supported through consistent in-kind donation tracking. For instance, the contributed food that is used in a feeding program should be recorded in the books of the foundation as both contribution revenue and program expense.

However, not all in-kind contributions are eligible for recognition, and proper in-kind donation tracking helps ensure that donated services satisfy specific conditions, such as using specialized skills that are performed only by professionals.

The consistent application of these rules assists in audit preparation and increases the level of financial transparency through reliable in-kind donation tracking.

How Donation Tracking Software Aids In-Kind Management

Relying on old-fashioned methods of tracking donations, the risk of errors, omissions, and inconsistencies is significantly higher, which makes reliable in-kind donation tracking difficult. However, donation tracking software provides a means through which nonprofit organizations can manage in-kind giving more efficiently.

Through a unified platform, organizations are able to log donation information, associate files, and create reports all at once, supporting consistent in-kind donation tracking. This not only enhances accuracy but also cuts down the time needed by staff.

Nonprofit tracking software donations also help out with regulations by making acknowledgment workflows uniform and keeping records that are always ready for audits, strengthening in-kind donation tracking. If nonprofits use structured systems, they will minimize the use of memory of staff memory or manual spreadsheets.

Connecting with larger systems for tracking nonprofit donations ensures that in-kind contributions are recorded with cash gifts and donor histories.

Also Read: How Volunteer Hour Tracking Drives Donor Cultivation Success

Integrating In-Kind Donations Into Nonprofit Donation Tracking

Donation tracking of nonprofits should incorporate all support types, not only cash. The inclusion of in-kind donations into the main donor record reveals donor engagement in totality.

Those who donate items or services usually get involved more and have a strengthened relationship with the organization, and effective in-kind donation tracking helps nonprofits recognize and document this engagement. Keeping a record of these donations enables nonprofits to show donor loyalty with corresponding stewarding actions.

Integration of tracking also leads to higher accuracy in reporting, supported by consistent in-kind donation tracking. Development teams, finance staff, and management get to benefit from having consistent data across departments.

When in-kind donations are dealt with in the same way as cash gifts, nonprofits ensure accountability and quality in their decision-making processes through reliable in-kind donation tracking.

Using a Donor Management System for In-Kind Gifts

It is essential that a donor management system be used to manage the in-kind donation data. Data such as donor profiles, contribution histories, and acknowledgment records all get stored together in the systems.

Nonprofits that log in-kind gifts along with cash donations get to know better their donors’ behavior and preferences. The collected information facilitates personalized communication and long-term engagement.

The donor management system is also essential for internal synchronization. The development, finance, and program departments can use the same data and, at the same time, avoid the time-consuming and laborious process of data duplication.

Thus, a nonprofit organization that is growing will find it easier to work with a structured system that allows for expansion and lessens the load of administrative tasks.

Common Mistakes Nonprofits Make With In-Kind Donations

During the handling of in-kind contributions, nonprofits often face difficulties caused by their own mistakes that could be avoided.

One of the main problems is the slow documentation of donations. Records that are delayed generally do not contain critical information necessary for either the valuation or the acknowledgment.

A different mistake is related to putting dollar values on donor receipts. This is against IRS rules and can raise compliance risk.

Moreover, there are instances of nonprofits failing to show in-kind donations in their financial statements, which leads to incomplete statements and underreported support.

In order to fix these issues, the introduction of clear rules, the provision of personnel training, and the installation of reliable systems to support in-kind donation tracking are the main steps to take.

Best Practices for Staying Compliant and Organized

One way for nonprofits to support their in-kind donation tracking is by adopting effective and proven best practices.

Written policies should be developed by the organizations that will define qualifying donations, valuation methods, and acknowledgment procedures. Training of the staff ensures that there is a consistent application.

An ongoing review of in-kind records helps to detect gaps early. Internal audits reinforce accuracy while the organization remains prepared for external reviews.

The use of technology is to limit human participation and to achieve consistency throughout the process. Organizations relying on such structured systems not only become compliant but also enhance their productivity.

Building Transparency and Trust Through Accurate Tracking

Transparency is regarded as a mainstay of trust with the supporters, such as donors, grantmakers, and regulators. In-kind donation tracing that is accurate signals that the nonprofit organization is serious about being liable.

Nonprofits strengthen donor confidence when they report contributions transparently and adhere to IRS regulations. This confidence leads to the success of fundraising for a longer period.

Also, clear records put the leadership in a position to make informed decisions. Knowledge of the entire range of resources can help organizations plan and show their impact effectively.

Conclusion

In-kind donations are a significant factor in the success of nonprofits, though they still need great management. If there are no proper practices for tracking, valuation, and compliance, these donations can turn into a risk instead of a value.

Nonprofits can manage in-kind gifts with assurance by setting up clear procedures, using uniform valuation practices, and observing IRS regulations. Trustworthy systems and deliberate documentation change confusion into understanding.

Nonprofits can manage in-kind donations just like cash donations; they will not only consolidate trust but also safeguard compliance and render their operation more visible to their supporters.

FAQ

What does an in-kind donation mean?

The term in-kind donation implies the donation of goods, professional services, or use of facilities to a nonprofit organization at no cost, which is considered a non-monetary donation.

Does a nonprofit assign an estimated cost to the items or services it has received as in-kind donations?

No, a nonprofit will write the information relating to the items or services being donated, but will not provide any estimated value on the receipt.

Is volunteer work considered an in-kind donation?

General volunteer work will not be viewed as qualifying for a charitable deduction under the IRS rules, but more narrowly specialized volunteer time will be considered qualifying under the IRS rules.

How can a nonprofit store in-kind donation records?

A nonprofit will want to standardize its donation recordkeeping by using a single database for storing all in-kind donations; this is essential for the IRS audit process.

Why is it important to track in-kind donations for IRS compliance?

Accurate accounting and reporting for in-kind donations ensures companies are complying with IRS regulations; these regulations require a non-profit organization to have complete financial transparency when preparing its tax returns and reporting the activities of the organization to the public.